Starting a home based business is one of the smartest ways to turn your skills or passions into profit.

Some links on this site are affiliate links, including Amazon affiliate links. As an Amazon Associate, I earn from qualifying purchases. If you click and make a purchase, I may earn a small commission—at no extra cost to you. I only recommend products I genuinely trust and use.

Whether you want to create an additional income stream or build a full-time career, knowing the foundational questions to ask can save you from expensive mistakes. From choosing the right business idea to handling taxes and legal requirements, these essentials will give you the clarity needed to move forward confidently. It’s not about reinventing the wheel—it’s about starting with the right plan.

Here’s how to start and build your home business correctly.

Understanding the Essentials of Starting a Home Based Business

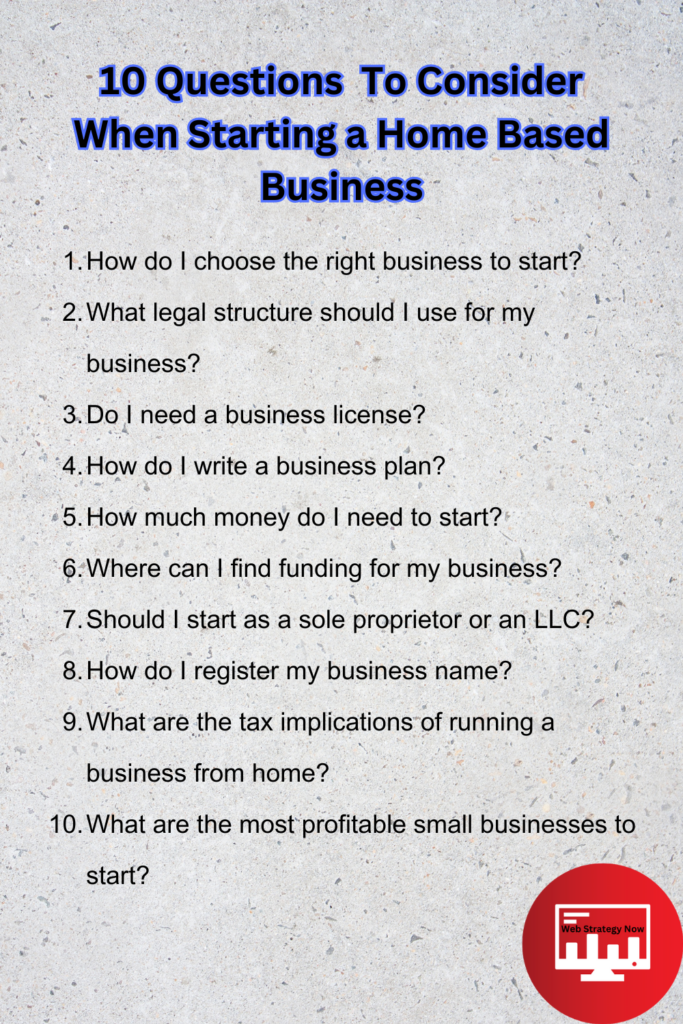

I am often asked these 10 key questions about starting a home based business.

- How do I choose the right business to start?

- What legal structure should I use for my business?

- Do I need a business license?

- How do I write a business plan?

- How much money do I need to start?

- Where can I find funding for my business?

- Should I start as a sole proprietor or an LLC?

- How do I register my business name?

- What are the tax implications of running a business from home?

- What are the most profitable small businesses to start?

By answering these questions, you’ll gain the insight and direction needed to launch your business confidently and clearly. Let’s break these down one by one.

How Do I Choose the Right Business to Start?

The right business starts with a combination of passion, skills, and market demand.

Take an honest look at what you enjoy doing, the skills you excel at, and what people are already paying for. For instance, if you love baking and have a knack for decorating cakes, you could explore starting a home based bakery. The key is to find the intersection between what you love, what you’re good at, and what solves a problem for others.

Start by brainstorming ideas and then validate them. Talk to potential customers, research competitors, and see if there’s enough demand to sustain your idea. Avoid choosing a business based solely on trends or what others are doing—it needs to align with your strengths.

When you choose a business that fits your skills and the market, you increase your chances of long-term success. Focusing on this intersection helps you build a business that’s not only profitable but also fulfilling to run.

To move forward, write down three to five potential business ideas and evaluate them based on your interests and the market demand.

What Legal Structure Should I Use for Starting My Home Based Business?

Choosing the right legal structure is critical for protecting your personal assets and setting up your business for success.

The most common structures for home based businesses are sole proprietorships, partnerships, LLCs (Limited Liability Companies), and corporations. Each has its pros and cons. A sole proprietorship is the simplest to start, but it doesn’t protect your personal assets if your business faces financial trouble. An LLC, on the other hand, offers liability protection and is a popular choice for small businesses.

Think about your business’s risk level, potential growth, and how much paperwork you’re willing to handle. For example, if you’re starting a freelance graphic design business with minimal risk, a sole proprietorship might work. However, if you’re launching a business with employees or higher risk, like a catering service, an LLC is a safer choice.

If you’re not sure which structure to choose, Legal Zoom can help you navigate the options and set up your business the right way.

Do I Need a Business License?

Most home based businesses need some type of business license or permit.

The requirements vary by location and industry, so it’s essential to check with your local government. For instance, a home bakery may require health permits, while an online consulting business might only need a general business license. Skipping this step can lead to fines or delays, so don’t overlook it.

If your business involves selling physical products, you may also need a sales tax permit. This allows you to collect and remit sales tax to your state. Some states also require home businesses to register for zoning permits to operate legally from a residential area.

To ensure you have all the necessary permits and licenses, consider using Legal Zoom for professional assistance.

How Do I Write a Business Plan?

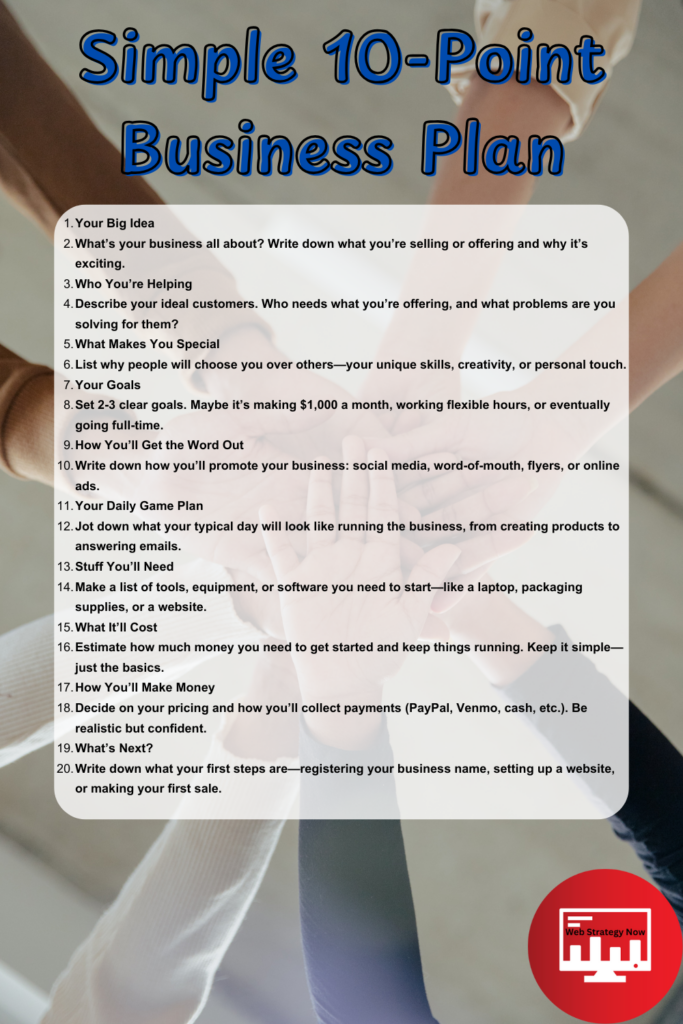

A business plan is your roadmap to success. Free Simple Business Plan Template Here.

Start by outlining your goals, target audience, and the steps you’ll take to reach them. Your plan should include an executive summary, a description of your business, a market analysis, an outline of your offerings, and a financial plan.

For example, if you’re starting an online tutoring business, detail how you’ll attract clients, what subjects you’ll cover, and how you’ll price your services. Be specific—include real numbers for costs, pricing, and projected income.

A well-written business plan doesn’t just guide your actions; it’s also essential if you’re seeking funding or investors. Keep it simple but comprehensive. This document will evolve as your business grows, so start with a clear but flexible plan.

How Much Money Do I Need to Start?

Your startup costs depend on the type of business you’re launching.

Some businesses, like freelance writing or virtual assistance, require minimal investment—just a computer and internet connection. Others, like a home bakery or crafts business, need funds for equipment, supplies, and marketing.

Start by listing all the expenses you’ll need to get your business off the ground. Break these into categories like equipment, marketing, and licensing. Don’t forget to account for ongoing costs like website hosting or software subscriptions.

Once you have a clear estimate, create a budget and prioritize the essentials. If money is tight, focus on the basics first and expand as you generate income.

Where Can I Find Funding for My Business?

Funding options for home based businesses vary based on your needs and credit history.

You can bootstrap your business by using personal savings, which gives you full control but limits how much you can invest upfront. If you need more capital, consider small business loans, lines of credit, or crowdfunding platforms.

For instance, if you’re starting a business selling handcrafted jewelry, you might run a crowdfunding campaign to pre-sell your products and raise funds for materials. Alternatively, local grants or small business contests can provide financial support without the need for repayment.

Explore your options and choose what fits your situation. The right funding can make a big difference in how quickly and successfully you launch.

Should I Start as a Sole Proprietor or an LLC?

This decision depends on your business’s complexity and risk.

A sole proprietorship is easy to set up and works well for low-risk businesses, like freelance writing. An LLC offers liability protection, which is crucial if your business has higher risks, like selling physical products or hiring employees.

Not sure which route to take? Legal Zoom simplifies the process and ensures you make the right choice for your situation.

How Do I Register My Business Name?

Registering your business name is a key step in making your business official.

Start by choosing a name that reflects your brand and isn’t already in use. Check your state’s business registry and domain availability to ensure the name is unique. Once you’ve decided, file the name with your state or local government.

If you’re forming an LLC or corporation, registering the name is part of the process. For sole proprietors, you may need to file a DBA (Doing Business As) name.

Need help registering your name? Legal Zoom can guide you through the process seamlessly.

What Are the Tax Implications of Running a Business from Home?

Running a home based business comes with tax benefits and responsibilities.

You can deduct expenses like a home office, utilities, and internet, but only if they’re used exclusively for your business. Keep detailed records to support your deductions in case of an audit.

On the flip side, you’ll need to pay self-employment taxes. This includes Social Security and Medicare contributions, which are typically handled by an employer.

Want to ensure you’re compliant and maximizing deductions? Legal Zoom offers expert tax guidance for small business owners.

What Are the Most Profitable Small Businesses to Start?

The most profitable businesses are those with low overhead and high demand.

Examples include virtual assistance, tutoring, bookkeeping, and freelance writing. Businesses offering unique handmade products or digital goods can also be highly profitable when marketed effectively.

Choose a business that aligns with your skills and has proven demand. Profitability comes down to providing value while keeping your costs manageable.

Building Your Dream Home Based Business

Starting a home based business is about taking action on a well-thought-out plan.

By addressing these key questions, you’ll have the clarity and confidence to launch a business that’s both profitable and fulfilling. Every decision, from choosing your business idea to registering your name, is a step toward your goals.

The journey starts now—pick your first step and get started today.